Do you know your flood risk? FEMA urges NJ residents to act now

Where it can rain, it can flood.

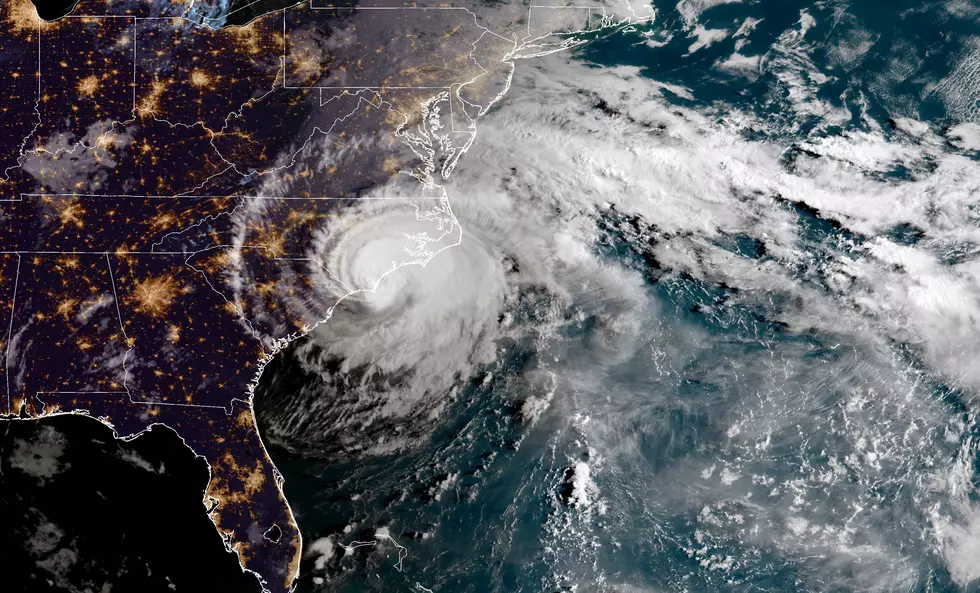

That's why on Thursday, the same day that U.S. officials confirmed their prediction of an above-average hurricane season in the Atlantic, the Federal Emergency Management Agency urged New Jersey residents to know their flood risk and obtain the proper protection.

"People need to quit thinking that it won't happen to them," David Maurstad, senior executive of the National Flood Insurance Program at FEMA, told New Jersey 101.5.

Homes in high-risk flood areas with government-backed mortgages are required to have flood insurance. But beyond that, one's homeowner's or renter's policy typically would not cover damage caused by flooding.

For the most part, flood insurance policies take 30 days to go into effect. The peak months for hurricane development are August, September, October, and November.

"It's important not to wait for that hurricane to develop in the Atlantic," Maurstad said. "If it's approaching, that's too late."

According to FEMA, just one inch of water in a home can cause roughly $25,000 in damage. Last September, the remnants of Hurricane Ida dropped approximately three inches of rain per hour and caused major disaster declarations in several New Jersey counties.

Forty percent of floods occur outside the high-risk flood zone, according to FEMA. About 90% of all U.S. natural disasters involve flooding.

Do you need flood insurance? Take this quiz.

The National Oceanic and Atmospheric Administration on Thursday trimmed their hurricane season outlook from a 65% chance for above-normal activity to a 60% chance. The agency predicts 14 to 20 named storms; that includes a few storms that formed in June and early July.

Dino Flammia is a reporter for New Jersey 101.5. You can reach him at dino.flammia@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

What would happen to NJ if we were attacked by nuclear weapons?

Cape May, NJ: 15 wonderful places to visit

More From 94.3 The Point